“Compound interest is the eighth wonder of the world. He who understands it, earns it … he who doesn’t … pays it.”

What is Compound Interest?

Compound interest is considered by many the eighth wonder of the world, or at least a quote ascribed to Albert Einstein claims it to be so. What is compound interest? According to Marriam Webster’s dictionary, compound interest is the interest computed on the sum of an original principal and accrued interest.

In other words, compound interest is the financial process in which the interest for each period is added to the initial capital to produce new interest. The magic happens the moment we re-invest the interests that we are getting with the initial investment.

Why is it important to invest?

The main lesson we get from Einstein’s quote is that positive actions taken today will provide a much larger benefit over an extended period of time because of compounding. The opposite also holds true; debt which accrues interest will work against you and get larger over time. Thanks to compound interest, we can get our initial investment to multiply exponentially over long periods of time. Let’s look at some numbers.

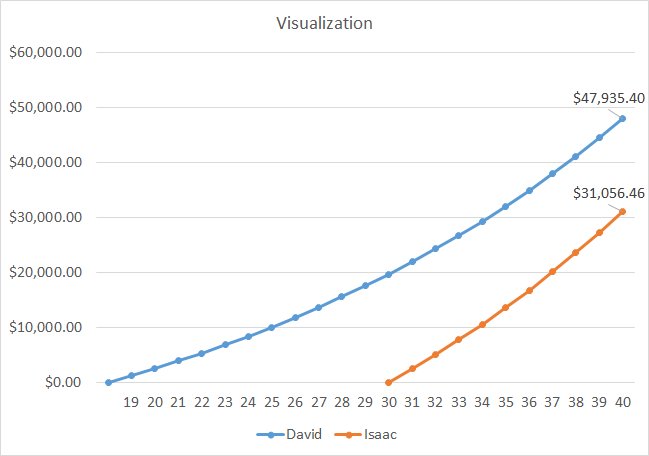

Assume that David starts saving $100/month ever since his first job at 18 years old and deposits it into a high yield savings account that offers 5% Annual Percentage Yield (APY). Isaac is not ready to start investing yet, as he feels he doesn’t earn enough money yet. He would rather start investing at 30 years old when he has a higher income and can afford to save $200/month (twice what David has been saving). Here is what both of their accounts would look like at 40 years old.

Based on the chart we see that David was able to save a total of almost $48,000 meanwhile Isaac saved $31,000. Not only that but David put in $26,400 of his own money (the money that would have been saved under the mattress, if not using an institution) and collected $21,735 in interest, almost doubling his money; while Isaac put in $24,000 of under-the-mattress money, and only collected $7,185 in interest. This all happened while David was putting aside only half of what Isaac decided to save.

The only way Isaac could have caught up would have been to save $300/month and even then he would be a bit short.

Lesson learned: Start Saving Early – For every 10 years you delay before starting to save, you will need to save three times as much each month to catch up.

On that note, let’s not continue riding the boat of spending every paycheck and avoiding investment opportunities. The faster you get ball rolling when it comes to saving and investment, the more you can take advantage of the benefits of compound interest.

Leave a Reply